Future Funds – B.B. Bank plc. helps you move money across borders with transparent foreign exchange, clear fee structures and realistic processing times – whether you are sending EUR within SEPA or making SWIFT payments worldwide.

Future Funds – B.B. Bank plc. provides a next-generation payments infrastructure designed for clients who operate across borders. Transfer funds faster, with lower fees, predictable execution times, and continuous access to global markets.

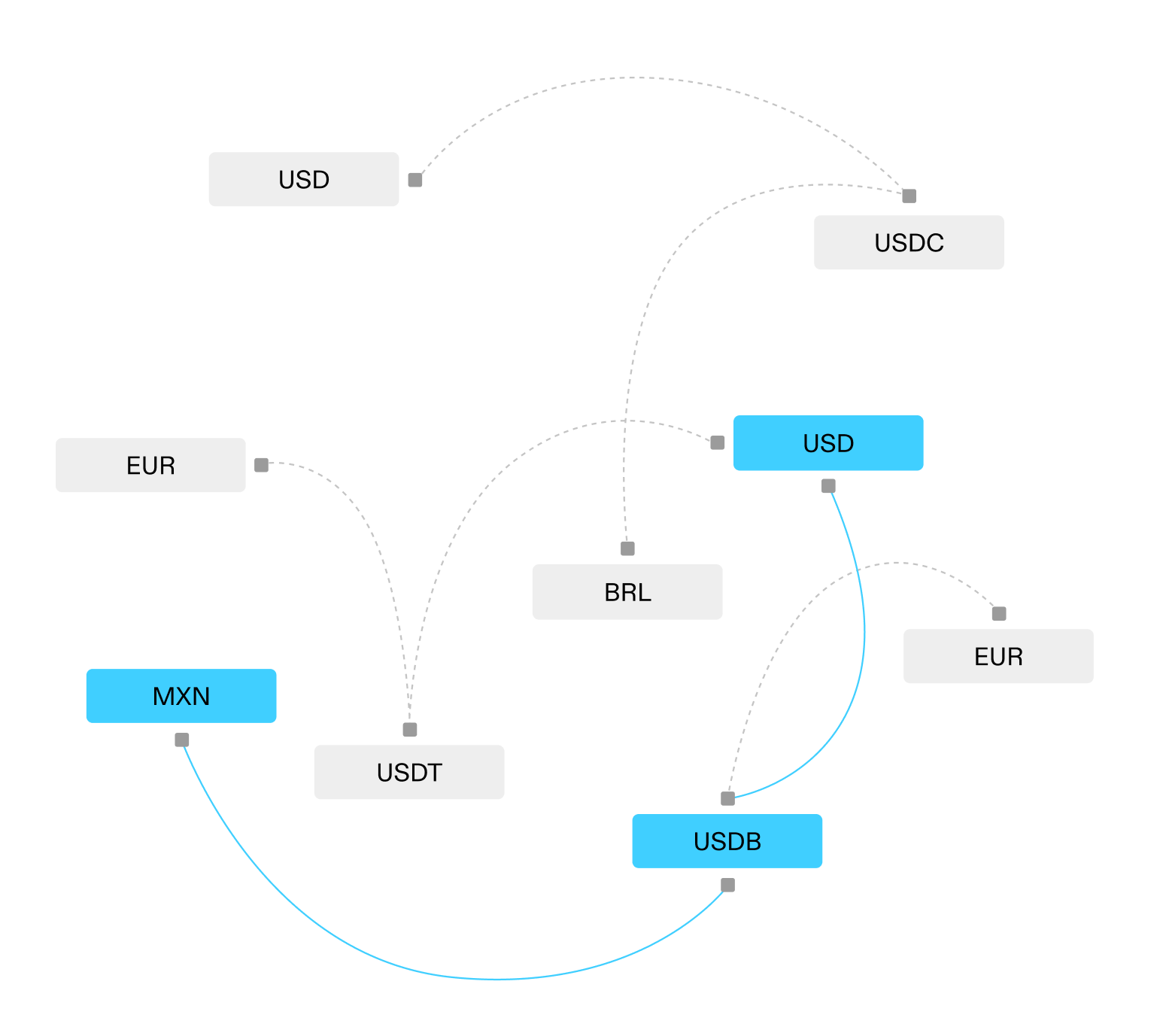

Hold and use multiple currencies directly on your FF accounts. This allows you to receive and send funds without converting every transaction.

When a transfer or card payment requires currency conversion, we display a clear FX spread and estimated converted amount before you confirm.

How cross-border payments, currencies and FX are handled when you use Future Funds – B.B. Bank plc for international transfers and online payments.